Understanding car title loan limits per vehicle is key for borrowers. Lenders assess vehicle age, make, model, and condition to determine these limits, impacting repayment options. Factors like mileage and market value influence amounts, with older vehicles typically qualifying for lower limits. A strong credit history enhances borrowing potential, securing higher amounts, better terms, and quicker funding. Maintaining the vehicle and timely payments also improve future loan opportunities.

..

- Understanding Car Title Loan Limits

- Factors Affecting Vehicle Loan Amounts

- Maximizing Your Car Title Loan Potential

Understanding Car Title Loan Limits

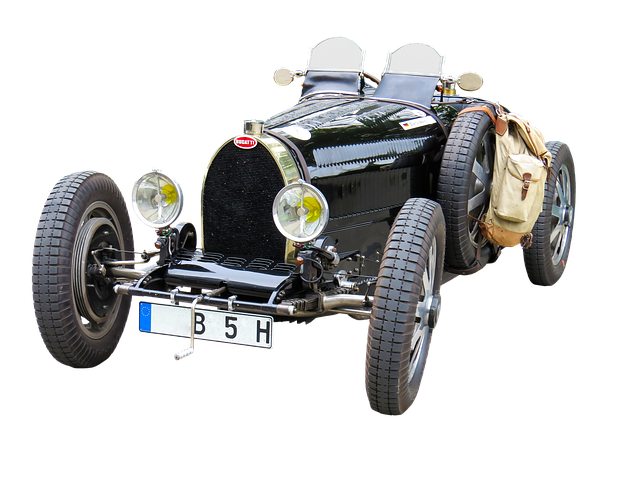

When considering a car title loan, understanding the limit set per vehicle is paramount. Lenders typically determine this limit based on several factors such as the vehicle’s age, make, model, and overall condition. The primary goal is to ensure the collateral—the vehicle itself—retains sufficient value throughout the loan period. This ensures that in case of default, the lender can easily liquidate the asset for repayment.

Knowing your car title loan limit per vehicle also provides insight into different repayment options. If you find the initial loan amount too high, exploring a lower-limit loan could be beneficial. Alternatively, if unexpected financial challenges arise during the payoff period, considering a loan extension might offer some breathing room without compromising on the overall cost. Repayment options and loan payoff strategies are key considerations that directly impact your borrowing experience.

Factors Affecting Vehicle Loan Amounts

Several factors influence the car title loan limit per vehicle, making it a variable process. Lenders consider the age and overall condition of the vehicle as primary determinants. Older cars or those with significant mileage might qualify for lower loan amounts since their resale value could be less. Conversely, newer vehicles with low mileage may command higher loan limits due to their increased worth.

Additionally, the market value of the car plays a substantial role in setting loan terms. Lenders assess this through comprehensive credit checks and appraisals. In cities like Dallas, where vehicle ownership is prevalent, understanding these factors is crucial when applying for a Car Title Loan. The absence or presence of a good credit history can impact the loan amount offered, as can the specific Loan Terms available from various lenders.

Maximizing Your Car Title Loan Potential

Maximizing your car title loan potential involves understanding the key factors that lenders consider when setting the limit for each vehicle. The primary determinant is the overall value of the car, which can be influenced by its make, model, age, and condition. Lenders assess these attributes to gauge the resale value of the vehicle if a default occurs, ensuring they have sufficient collateral to recover their investment.

Additionally, your credit history plays a significant role in securing a higher loan amount. A strong credit score demonstrates financial responsibility and increases your chances of receiving a larger car title loan. Lenders often offer better terms and interest rates to borrowers with excellent credit, including quicker funding times. Keeping your vehicle well-maintained and meeting all loan payments on time can also positively impact your borrowing potential over time.

When considering a car title loan, understanding the limits set by lenders based on your vehicle’s value is crucial. Several factors, such as age, make, model, and overall condition, influence the loan amount you can secure. By maximizing the potential of your vehicle through proper maintenance and ensuring its optimal condition, you can access higher loan limits. Remember that while car title loans offer a quick solution for emergency funding, responsible borrowing and adhering to the set limits are essential to avoid financial strain in the long term.